Simple, Fast Roof Financing Options

We’ve teamed up with GreenSky, the leader in home improvement financing, to find you competitive loan options that can help you pay for the job while getting the project done right.

WHY GREENSKY

- Promotional loan options

- Low, fixed monthly payments

- Credit limits up to $100k

- Instant credit decision

- No prepayment penalties

- No application fees

- Funding in as soon as 24 hours

HOW IT WORKS

- Complete below:

- Review loan options:

- Get funding in as soon as 24 hours:

FAQS

Q: What information do I need to apply?

GreenSky’s loan application will ask you for your basic information such as name, address, phone number, SSN, income, etc.

Q: Why should I use GreenSky instead of my credit card?

Interest rates on credit cards are often much higher than those on loans you’ll find through GreenSky.

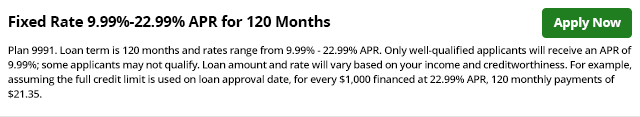

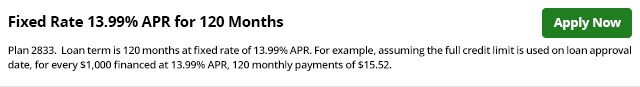

Q: What kind of loans are available through GreenSky?

GreenSky offers a wide range of signature loan options from same-as-cash style loans to low monthly payment options ranging from 3 to 18 years.

Q: When is my first payment due?

Your first payment will be due 30 days from the first transaction.

Q: How do I make payment on the loan?

You have the option to pay via GreenSky’s online customer portal or via check. GreenSky does not accept credit cards for payment on your loan.